Business Insurance in and around Traverse City

One of Traverse City’s top choices for small business insurance.

This small business insurance is not risky

State Farm Understands Small Businesses.

Though you work so hard to ensure otherwise, it is good to recognize that some things are simply out of your control. Mishaps happen, like an employee gets hurt on your property.

One of Traverse City’s top choices for small business insurance.

This small business insurance is not risky

Keep Your Business Secure

Protecting your business from these potential mishaps is as easy as choosing State Farm. With this small business insurance, agent John Haddix can not only help you devise a policy that will fit your needs, but can also help you submit a claim should a mishap like this arise.

Take the next step of preparation and visit State Farm agent John Haddix's team. They're happy to help you explore the options that may be right for you and your small business!

Simple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

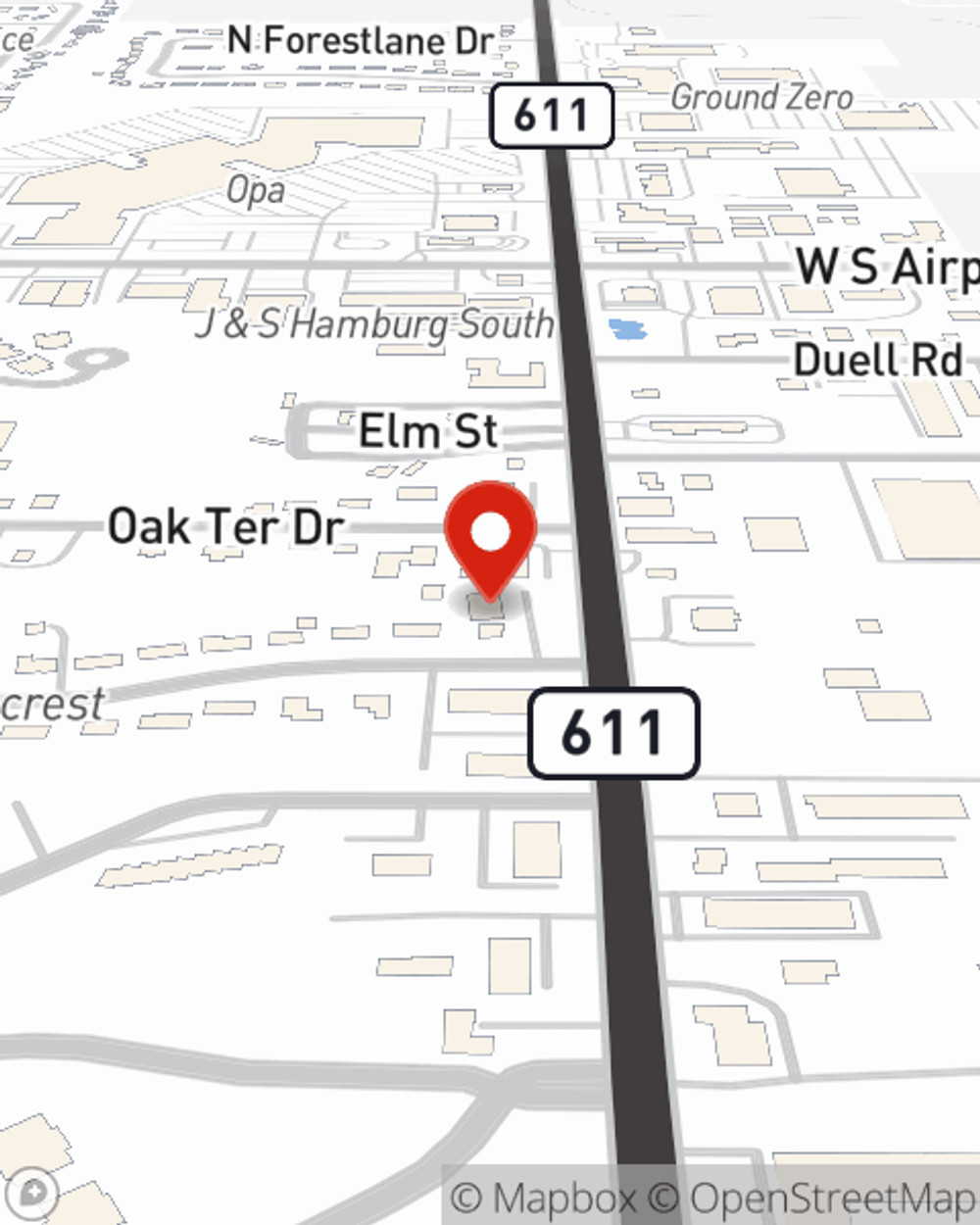

John Haddix

State Farm® Insurance AgentSimple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.